The public counter of Laois Motor Tax Office is currently open from 9.30am to 1pm (Monday-Friday, excluding public holidays). Applications can be accepted in person at the counter, or by post.

If you have any queries not addressed below, please do not hesitate to call us on 057 866 4009.

Please note that motor tax cannot renewed over the phone.

If you have a query regarding online motor tax payments (via www.motortax.ie), please contact the Department of Transport on 0818 411 412, or email motortax@transport.gov.ie.

- What are the Motor Tax rates?

- What documents do I need to renew my tax?

- When are arrears due?

- How do I update changes to me or my vehicle since I last taxed?

- What documents do I need to tax a new or imported vehicle privately for the first time?

- How should change of ownership be completed?

- What if I lose or need to replace documents?

- Can I renew my motor tax on-line?

- What do I need to register my trailer for the first time?

- What do I need to make a Trade Plate application?

- What is a goods Vehicle?

- What do I require when taxing Commercially?

1) What are the Motor Tax rates?

To check the rates for a given registration number, please click here.

Motor tax rates by assessment bases are available here.

All cars registered from 1 July 2008 and taxed as private vehicles, will have their motor tax rate based on the CO2 emissions level. The CO2 based system will not apply to second-hand imports that were registered abroad prior to 2008.

Cars registered before 2008 (i.e. cars in the motor tax system before 2008) will continue to be taxed under the then-existing system related to engine size (cc).

Commercial vehicles taxed at the private rate, will always have their motor tax rate based on the engine size.

2) What documents do I need to renew my tax?

- A fully completed and signed Renewal Form RF100A / RF100B

- Correct Fee

A blank RF100A renewal form is available here.

Please note that additional requirements may apply if you are availing of a reduced rate (e.g. taxi, goods/commercial vehicle etc.).

If any changes are to be made (e.g. change of ownership or address), the Vehicle Registration Certificate will be required.

3) When are arrears due?

Tax is issued from current month, arrears are payable for previous months not taxed if vehicle is in your name.

4) How do I update changes to me or my vehicle since I last taxed?

Changes of name and/or address can be updated by completing the reverse side of the Vehicle Licensing Certificate or the Registration Certificate and submitting to the Motor Tax Office.

5) What documents do I need to tax a new or imported vehicle privately for the first time?

You will need a fully completed and signed RF 100 Form [This form is received by the customer from the garage of purchase; for imported used vehicles it is received from the Revenue Commissioners] and the correct fee.

6) How should a change of ownership be completed?

Both parties must complete Part B of the Vehicle Licensing Certificate or the reverse side of the Registration Certificate. The seller sends this document to the Vehicle Registration Unit who will update the registered details and issue a Registration Certificate to the new owner:

Vehicle Registration Unit,

Department of Transport,

Shannon Town Centre,

Shannon,

Co. Clare.

For vehicles with the older ‘brown card’ registration books (generally vehicles registered prior to 1993), both parties should complete the RF200 transfer of ownership form, and submit that with the registration book to the Motor Tax Office.

The registration book will be stamped and returned to the new owner.

7) What if I lose or need to replace documents?

Complete the form RF134 Application for Replacement Document, declaring what document has been lost, destroyed or stolen. This form must be signed and stamped at a Garda station.

Submit this form to your local Motor Tax Office with the correct fee (€6 for a replacement tax disc; €12 for a replacement Vehicle Registration Certificate).

Please note that replacement NCT certificates can only be issued by the NCTS (details here: https://www.ncts.ie/1123/).

Replacement Certificates of Roadworthiness (for commercial vehicles) can be requested online at https://operator.cvrt.ie/vehicle/requestCRWpublic.

8) Can I renew my motor tax on-line?

YES, if there is a PIN number printed on the front of your Renewal Form RF100B. Log onto www.motortax.ie. You will require your PIN number from your RF100B, insurance details and credit card details.

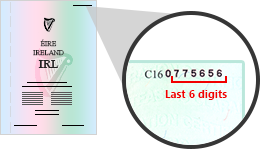

Your PIN number can also be located on the front of your Vehicle Registration Certificate (logbook), being the last six digits of the serial number in the top-right corner:

For newly registered/imported vehicles, a VRC will not have been issued prior to taxing for the first time. The PIN will be the last six digits of the vehicle’s chassis number (VIN).

There is also an online PIN retrieval service available here. The vehicle owner must enter the registration number; their name and address as they appear on the Vehicle Registration Certificate; and an email address to which the PIN will be sent.

9) What do I need to register my trailer for the first time?

All trailers with a Gross Design Weight (DGVW) of more than 3,500 kg must be registered at your local motor tax office, including brand new and imported trailers.

For trailers manufactured before 29th October 2012 you will need:

- Form TF100 – Must be fully complete and Declaration form signed/dated.

- TF300B – Manufacturer’s/Assemblers Certificate stamped, signed and dated by the manufacturer/assembler of the Trailer or their authorized agent.

- Proof of address (i.e. utility bill within last 3 months)

- PPS/VAT Number

- Original Invoice or Lease Agreement for purchase of trailer showing the VIN/Chassis No

- Fee of €60

For trailers manufactured on or after 29th October 2012 you will need:

- Form TF100 – Must be fully complete and Declaration form signed/dated.

- TF300A – Weight Identification Certificate.

- Plus an acceptable Certificate of Approval (one of the below):

- An EC Certificate of Conformity (EC CoC) for a complete or completed trailer (meets EU approval & allows the trailer enter into service in any member state of the EU – must be in English/Irish)

- Irish National Small Series Type Approval Certificate of Conformity (NSSTA CoC) for a complete or completed trailer (meets Ireland’s approval approved by NSAI – provided by distributor/manufacturer)

- Irish Individual Vehicle Approval Certificate (IVA Certificate) – meets Ireland’s approval for trailers imported or special/individual trailers

- If imported & evidence of national approval certificate from an EU member state, the owner should be asked to contact the NSAI to have the trailer examined & verified and, once all requirements met, the NSA will issue an Irish IVA certificate for the trailer.

- Proof of address (i.e. utility bill within last 3 months)

- PPS/VAT Number

- Original Invoice or Lease Agreement for purchase of trailer showing the VIN/Chassis No

- Fee of €60

Please note that the trailer card cannot be issued out over the counter, but will be posted out to the registered address.

A replacement trailer licence card can be issued upon receipt of a RF134 Application for Replacement Document form (signed and stamped at a Garda station) and the €6 replacement fee.

Changes in ownership for a trailer may be completed by returning the trailer card and a TF200 (Notification of Transfer of Trailer Ownership) form, to the motor tax office.

10) What do I need to make a Trade Plate application?

- A Garage code issued by the Vehicle Registration Unit. If you need to apply for a Garage code, you should contact The Vehicle Registration Unit, Shannon Town Centre, Co Clare 061 365000.

- Fully completed and signed Trade Licence Application Form RF700.

- Evidence of registration for Value Added Tax (or where turnover does not exceed the minimum amount for VAT registration, the RSI number of the applicant).

- Evidence of valuation for Rating Purposes of the applicants premises (a rates bill or letter will suffice). If the premises are new and not yet valued, evidence of planning permission will suffice.

- Motor trade insurance certificate.

- The correct fee: €59 for a single motor cycle plate; €353 for all other vehicles (set of 2 plates).

11) What is a goods Vehicle?

A Goods vehicle is a vehicle constructed or adapted for use and used for the conveyance of goods or burden of any other description in the course of trade or business.

The following conditions must be satisfied:

The goods carrying area must be greater than the seating area. All seats to the rear of the drivers seat to be removed and seat bolts holes welded over All rear seat belts removed and seat belt anchor points welded over.

12) What do I require when taxing Commercially?

The requirements for the first time taxing of a goods vehicle in the current ownership, not exceeding 3,500kg design gross vehicle weight (DGVW):

| Limited Company

1 2 5 & 6 as listed below |

| Self Employed Person

All documents as listed 1-6 below AND · VAT evidence or · Notice of assessment/self assessment or · Correspondence on Revenue headed paper that indicates you are registered as self employed or · A letter from a registered accountant on their headed paper stating that “ They act as your Agent, that you are registered for income Tax as a Sole Trader and that your business is currently trading” (A tax clearance cert or a herd number is not acceptable) |

Employee

All documents as listed 1-6 below AND A letter from their employer on company headed paper (showing VAT/revenue registration number) stating that the vehicle is used solely during the course of the applicants employment with their business. Letter must contain: · Applicants name and address · Registration of the vehicle in question · The wording “uses vehicle solely during the course of their employment with our business |

All documents listed above must not be dated over 6 months old and are solely to satisfy the business or trade requirements to tax a goods vehicle

- RF100A/RF100B – where the vehicle is being taxed for the first time in the current ownership OR RF100 – where the vehicle is newly registered in the state – this includes imported vehicles that have been registered through NCT centre

- A completed goods only declaration form RF111A – this form must be stamped and signature of registered owner witnessed at a Garda station.

- The original certificate of insurance – which must state that the applicant/vehicle concerned is covered for carriage of goods in the course of his/her business ( the nature of this business must match that which is stated on your goods only declaration form RF111A)

- The CRW (certificate of roadworthiness) must be current if the vehicle is 1 year old or over

- A weight docket from an Authorised Weighbridge.

- VRC – Vehicle Licensing Certificate (Log Book) (for vehicles not newly registered in the state)

Where the vehicle has a weight exceeding 3,500kg (as per the weight docket), the following will be sufficient:

- RF100A/RF100B – where the vehicle is being taxed for the first time in the current ownership, or RF100 – where the vehicle is newly registered in the state – this includes imported vehicles that have been registered through an NCT centre

- The CRW (certificate of roadworthiness) must be current if the vehicle is 1 year old or over

- A weight docket from an authorised weighbridge, and a weighmaster’s certificate. Please note that in the case of articulated tractors, the vehicle must be weighed along with the heaviest trailer it will be drawing (both the vehicle’s registration number and the trailer mark must be noted on the weight docket).

- VRC – Vehicle Licensing Certificate (Log Book) (for vehicles not newly registered in the state)

Notes:

- If the vehicle is used in any private capacity, it must be taxed at the private rate. Vehicles taxed at the private rate may still be used for commercial/goods-carrying purposes, with the exception of parking in loading bays.

- The private rate of tax applied to vehicles deemed to be commercial at the time of first registration in the state is based only on the vehicle engine size and not on emissions

- The Motor Taxation Office, in its absolute discretion, may require additional information