Laois Motor Tax Office is open from 9.30am to 1pm (Monday to Friday, excluding public holidays).

If you have any queries not addressed below, please do not hesitate to call us on 057 866 4009.

Please note that motor tax cannot be renewed over the phone.

- How to tax my vehicle

- Online motor tax application

- Forgotten PIN

- Vehicles that cannot be taxed online

- Motor tax arrears

- Further information

How can I tax my vehicle?

Applications can be accepted in person, or by post. There is also a drop box on the right hand side of the main reception door. Outside of our opening hours, forms should be put in an envelope clearly marked for the attention of Motor Tax.

Requirements

The following is required to tax your vehicle:

A fully completed and signed RF100A or RF100B renewal form. A blank RF100A form can be downloaded below. The RF100B is the renewal form which may have been issued to you from the Department of Transport and is green/white in colour.

If the vehicle is new or imported, an RF100 form must be completed when being taxed in Ireland for the first time.

- The correct fee. To check the current rates for a given registration number, please click here.

Note that if a vehicle was last taxed at a reduced rate (e.g. taxi, goods-carrying vehicle etc.) that reduced rate will be displayed.

Please note that additional documents may be required if you are applying for a reduced rate of motor tax.

If any changes relating to the owner are required for example change of ownership or address, the Vehicle Registration Certificate will also be needed.

Online motor tax applications

You can also pay motor tax online at the:

Motor Tax Online website

This service is run by the Department of Transport. If you have a query regarding online motor tax payments using the Motor Tax Online portal please contact 0818 411 412, or email motortax@transport.gov.ie

You will require your vehicle registration number, renewal PIN, and credit/debit card details.

If you have received a renewal reminder by post or email, your renewal PIN will be given there.

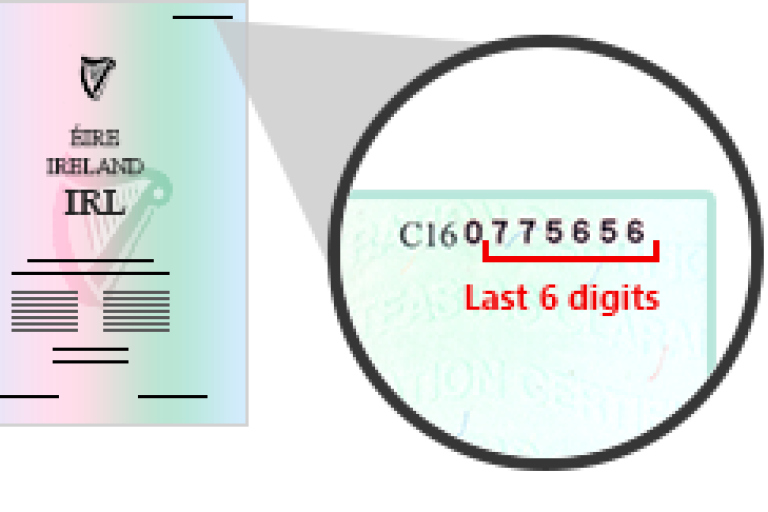

The PIN can also be located on the front of your Vehicle Registration Certificate (logbook). It is the last six digits of the serial number in the top-right corner:

For a new or recently-imported vehicle, a vehicle registration certificate (VRC) only issues after you have taxed it for the first time. In this case, your PIN will be the last six digits of the vehicle’s chassis number (VIN).

I have forgotten my pin

If you have forgotten your pin please go to the PIN retrieval service

The vehicle owner must enter the registration number, their name and address. An email confirming the PIN will be sent to the email address supplied when the vehicle was last taxed.

What vehicles cannot be taxed online?

There are certain vehicles that cannot be taxed online for the first time in a new ownership:

- motor caravans

- youth/community buses

- goods-carrying vehicles

These vehicles must be taxed in your local Motor Tax Office for the first application in your ownership. After that, they may be renewed online when taxing again.

Please note that Large Public Service Vehicles (buses) cannot be taxed online.

Motor tax arrears

Please note:

- Your tax disc will start from the month in which you apply for your motor tax. It is not possible to commence a disc from a prior month.

- Arrears are payable for any previous months the vehicle is in your ownership, unless the vehicle was officially declared off the road within 21 days of purchase.

Further information